This can include one or more of a debenture against the business’s assets, a personal guarantee from a director or a warranty (similar to a personal guarantee, where a factoring company must legally prove a business client unable to recover its advances). Invoice factoring companies will almost always require security to set up a new facility with a business client. Security – debentures, personal guarantees and warranties In ‘Recourse’ facilities there is no credit insurance and so in the event of a default the business will have to pay back any funds previously advanced against relevant invoices. This means if the business’s customers default or go into insolvency the funds tied up in unpaid invoices can be recovered. _Credit insurance, ‘Recourse’ and ‘Non-recourse’_Many factoring facilities include credit insurance - these are called ‘Non-recourse’ facilities. Some factoring companies will quote based on the business client maintaining ongoing responsibility for credit control. Stands for ‘Client Handles Own Credit Control’. It is usually a percentage and charged against the invoice value, including VAT. This means that the business incurs an additional ‘Refactoring Fee' and the invoice is 'recoursed' back to the business (the business will have to pay back any funds previously advanced against the invoice). If an invoice is left unpaid by a customer for a certain number of days (the agreed ‘Approval Period’), it won't be funded by the factoring company. Some are ‘Confidential’, where the customers are unaware.

the business client’s customers are aware that they are paying invoices to a factoring company. Most factoring facilities are ‘Disclosed’, i.e. same-day bank payments, receiving letters, credit checks, admin errors etc.

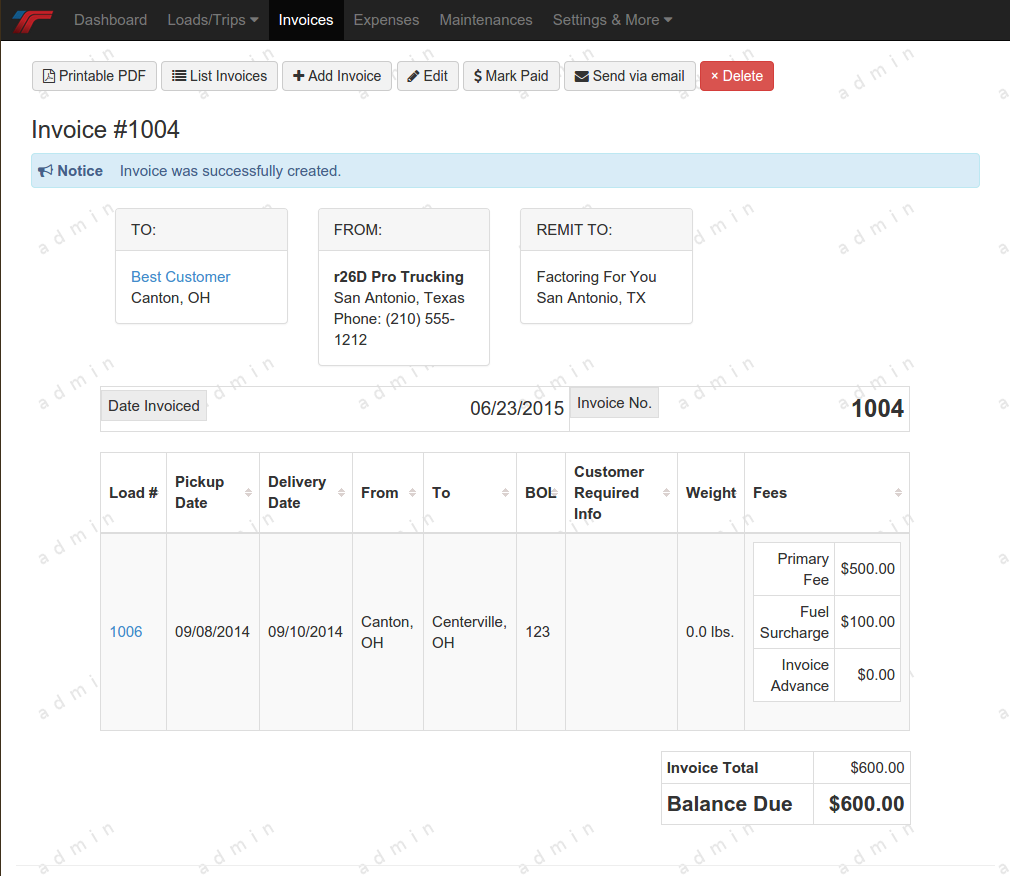

Invoice factoring companies will charge fees for all kinds of ‘out of the ordinary’ services, i.e. That is because often it is important to small businesses to maintain healthy and friendly relationships with their customers.Īnother word for ‘extra fees’. Ī lot of business clients prefer to maintain their own credit control rather than enter into a factoring facility that insists on chasing their customers for payment. There are often also limits on invoices due to foreign customers for export activity. This is due to factoring companies stipulating low ‘concentration limits’. Many factoring facilities are unsuitable for businesses which deal mostly with one or two main customers. Invoice factoring companies will often quote favourable rates and fees at the outset but the addition of extra fees (or ‘disbursements’) on a monthly basis adds considerable cost and makes this an expensive form of finance. Most factoring companies lock their customers into a long contract whereby all of their sales ledger must be funded through the factoring facility, and these contracts are often costly and difficult to get out of. Most factoring providers will manage credit control, too, meaning that the business no longer needs to chase customers for invoice payment - something that can save a lot of admin time. This makes cash flow management easier for the businesses that use factoring. When the end customer comes to pay, the factoring company collects the debt and makes the remaining balance available to the business client, minus their fees.įor a fee, factoring companies can unlock funds tied up in unpaid invoices so that your business receives funds without waiting for customers to pay.In return, the factoring company advances some funds upfront when the business client sends an invoice to a customer- typically 70-85%.The business client enters into an agreement with the factoring company whereby the company will manage their sales ledger and credit control on an ongoing basis for a fixed period (the term of the factoring contract, typically 24 months).Invoice factoring can be provided by independent finance providers, or by banks.Īround 45,000 businesses in the UK currently use factoring ( ABFA as at Q3 2015 )ĭebt factoring Invoice finance Asset based lending Invoice factoring is a way for businesses to fund cash flow by selling their invoices to a third party (a factor, or factoring company) at a discount.

0 kommentar(er)

0 kommentar(er)